Out Of Network

Identification and Recovery

Zero Risk. Maximum Reimbursements.

Schedule a quick 15-30 minute call with us for a free consultation to determine your healthcare organization’s needs!

Our Claims Recovery Services

Pre-Payment Recovery: Negotiations Service

Post-Payment Recovery: Appeals Service

Why Choose Us

We Are Success-Based

Decades of Expertise

Largest Healthcare Database

Specialized

If you don't get paid on your out-of-network claims, neither do we – which means we work even harder to identify and recover reimbursements on your out-of-network claims. With our no risk approach, it’s a no brainer!

We have over 20 years’ experience in the industry. We’ve built a unique team of experts who worked directly for the largest cost containment vendors and insurance companies, giving us the unique ability to understand their strategies and motives which allows us to stay ahead and get higher payments on bills for our customers. Our team offers advanced workflow processes to successfully navigate the complicated regulation surrounding the reimbursement processes.

To get our high yielding results, we rely on CRXIS, our proprietary data and analytics tool we’ve developed to support us as we go toe-to-toe with payors. CRXIS is the largest health data network in the industry, and helps analyze insurance policies, provides comparable data, and allows us to track the tendencies and trends of the people on the side of the insurance companies and cost-containment vendors.

We don't replace your billing team; we support them behind the scenes! Fighting these claims isn't part of the standard process for any billing team. It's nearly impossible for your staff to dedicate the necessary time and resources to identify, track, and challenge hundreds of claims. Our team has the specialized expertise and data to ensure your billing team can focus on their primary tasks.

Why Choose Us

We Are Success-Based

If you don't get paid on your out-of-network claims, neither do we – which means we work even harder to identify and recover reimbursements on your out-of-network claims. With our no risk approach, it’s a no brainer!

Decades of Expertise

We have over 20 years’ experience in the industry. We’ve built a unique team of experts who worked directly for the largest cost containment vendors and insurance companies, giving us the unique ability to understand their strategies and motives which allows us to stay ahead and get higher payments on bills for our customers. Our team offers advanced workflow processes to successfully navigate the complicated regulation surrounding the reimbursement processes.

Largest Healthcare Database

To get our high yielding results, we rely on CRXIS, our proprietary data and analytics tool we’ve developed to support us as we go toe-to-toe with payors. CRXIS is the largest health data network in the industry, and helps analyze insurance policies, provides comparable data, and allows us to track the tendencies and trends of the people on the side of the insurance companies and cost-containment vendors.

Specialized

We don't replace your billing team; we support them behind the scenes! Fighting these claims isn't part of the standard process for any billing team. It's nearly impossible for your staff to dedicate the necessary time and resources to identify, track, and challenge hundreds of claims. Our team has the specialized expertise and data to ensure your billing team can focus on their primary tasks.

If you don't get paid on your out-of-network claims, neither do we – which means we work even harder to identify and recover reimbursements on your out-of-network claims. With our no risk approach, it’s a no brainer!

We have over 20 years’ experience in the industry. We’ve built a unique team of experts who worked directly for the largest cost containment vendors and insurance companies, giving us the unique ability to understand their strategies and motives which allows us to stay ahead and get higher payments on bills for our customers. Our team offers advanced workflow processes to successfully navigate the complicated regulation surrounding the reimbursement processes.

To get our high yielding results, we rely on CRXIS, our proprietary data and analytics tool we’ve developed to support us as we go toe-to-toe with payors. CRXIS is the largest health data network in the industry, and helps analyze insurance policies, provides comparable data, and allows us to track the tendencies and trends of the people on the side of the insurance companies and cost-containment vendors.

We don't replace your billing team; we support them behind the scenes! Fighting these claims isn't part of the standard process for any billing team. It's nearly impossible for your staff to dedicate the necessary time and resources to identify, track, and challenge hundreds of claims. Our team has the specialized expertise and data to ensure your billing team can focus on their primary tasks.

Who We Serve

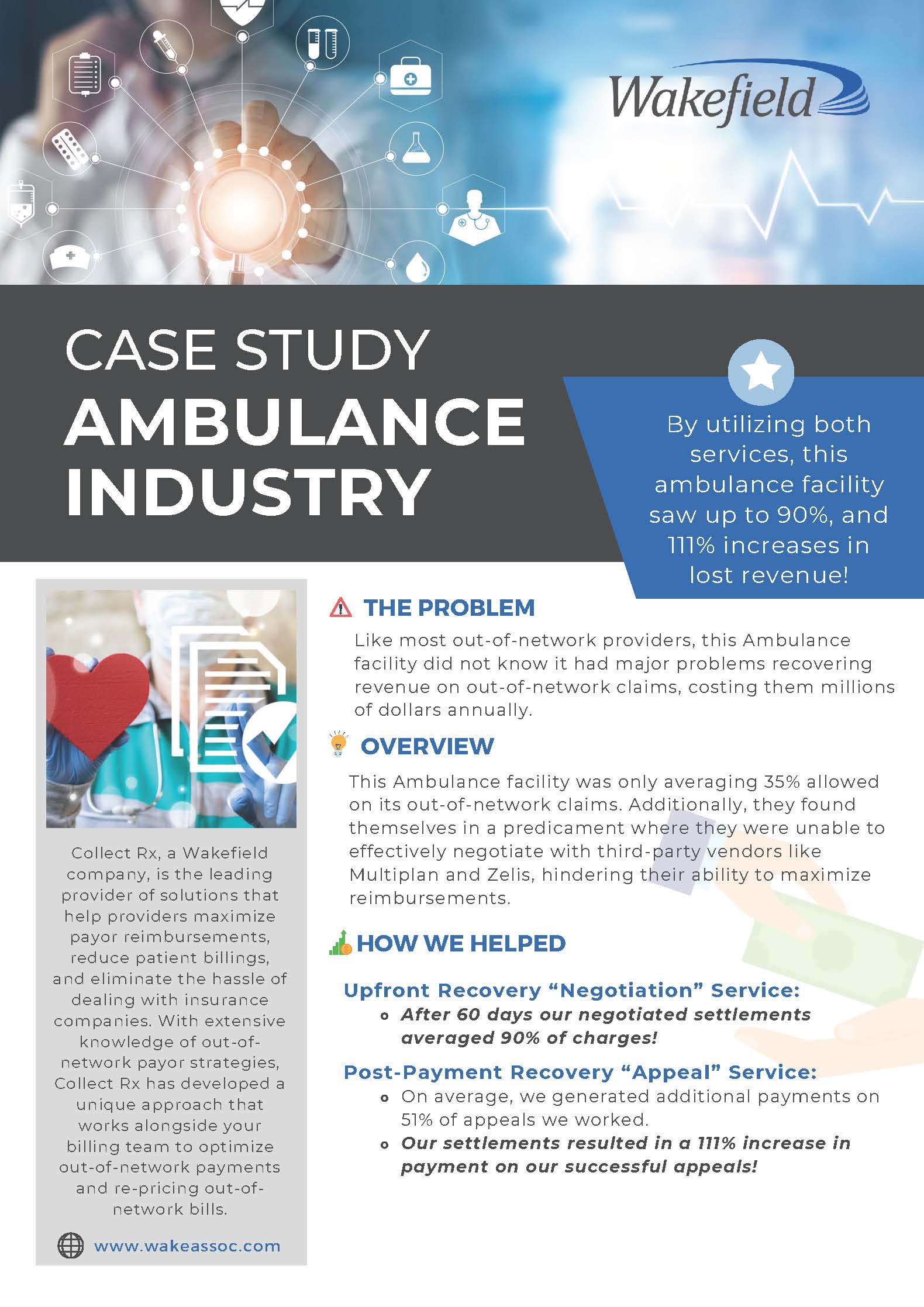

Ambulatory Surgery Centers

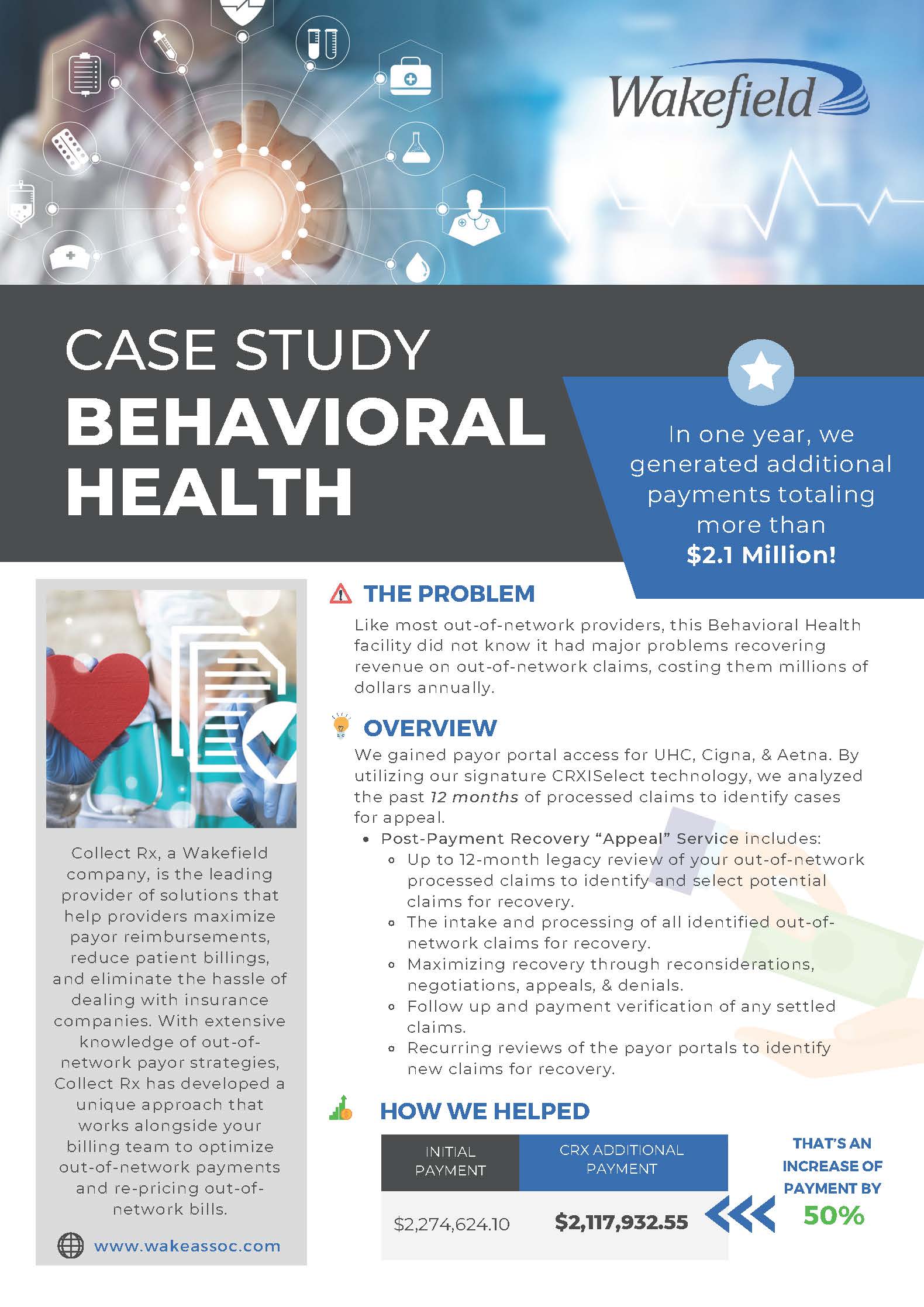

Behavioral Health Providers

Laboratories & Diagnostic Centers

Hospitals

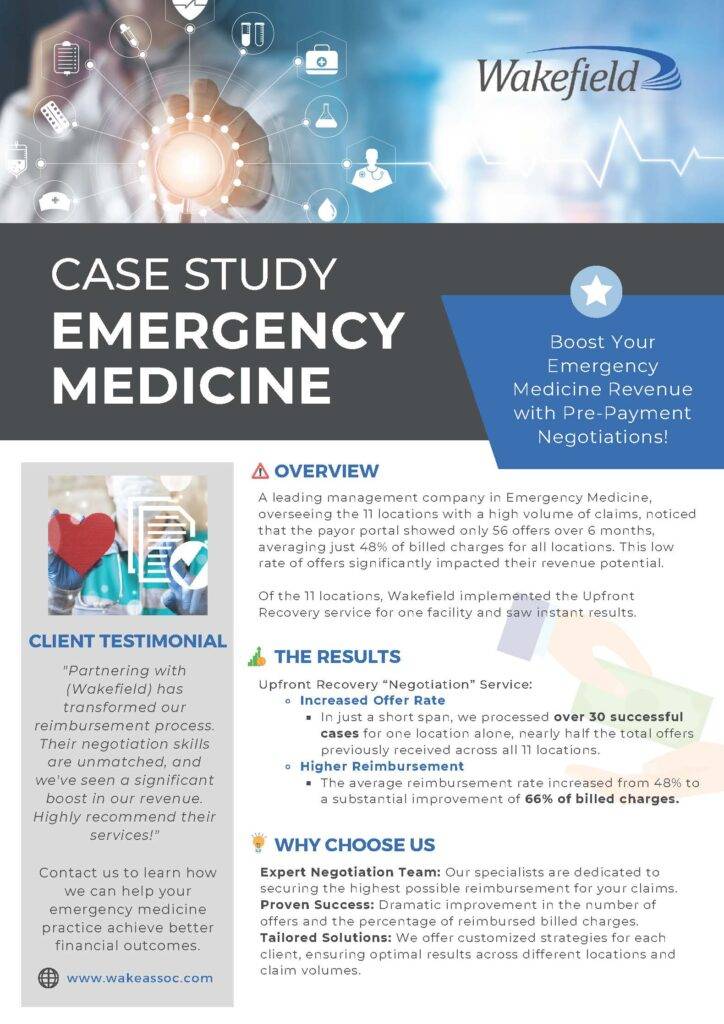

Emergency Medicine

Physician Groups